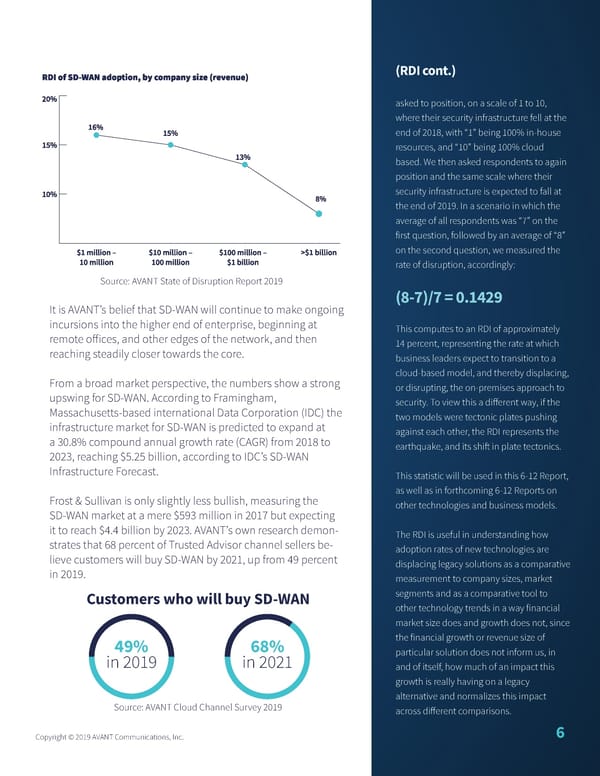

(RDI cont.) asked to position, on a scale of 1 to 10, where their security infrastructure fell at the end of 2018, with “1” being 100% in-house resources, and “10” being 100% cloud based. We then asked respondents to again position and the same scale where their security infrastructure is expected to fall at the end of 2019. In a scenario in which the average of all respondents was “7” on the first question, followed by an average of “8” on the second question, we measured the rate of disruption, accordingly: Source: AVANT State of Disruption Report 2019 (8-7)/7 = 0.1429 It is AVANT’s belief that SD-WAN will continue to make ongoing incursions into the higher end of enterprise, beginning at This computes to an RDI of approximately remote offices, and other edges of the network, and then 14 percent, representing the rate at which reaching steadily closer towards the core. business leaders expect to transition to a From a broad market perspective, the numbers show a strong cloud-based model, and thereby displacing, upswing for SD-WAN. According to Framingham, or disrupting, the on-premises approach to Massachusetts-based international Data Corporation (IDC) the security. To view this a different way, if the infrastructure market for SD-WAN is predicted to expand at two models were tectonic plates pushing a 30.8% compound annual growth rate (CAGR) from 2018 to against each other, the RDI represents the 2023, reaching $5.25 billion, according to IDC’s SD-WAN earthquake, and its shift in plate tectonics. Infrastructure Forecast. This statistic will be used in this 6-12 Report, Frost & Sullivan is only slightly less bullish, measuring the as well as in forthcoming 6-12 Reports on SD-WAN market at a mere $593 million in 2017 but expecting other technologies and business models. it to reach $4.4 billion by 2023. AVANT’s own research demon- The RDI is useful in understanding how strates that 68 percent of Trusted Advisor channel sellers be- adoption rates of new technologies are lieve customers will buy SD-WAN by 2021, up from 49 percent displacing legacy solutions as a comparative in 2019. measurement to company sizes, market Customers who will buy SD-WAN segments and as a comparative tool to other technology trends in a way financial market size does and growth does not, since 49% 68% the financial growth or revenue size of in 2019 in 2021 particular solution does not inform us, in and of itself, how much of an impact this growth is really having on a legacy alternative and normalizes this impact Source: AVANT Cloud Channel Survey 2019 across different comparisons. Copyright © 2019 AVANT Communications, Inc. 6

6 12 Report Research Page 6 Page 8

6 12 Report Research Page 6 Page 8