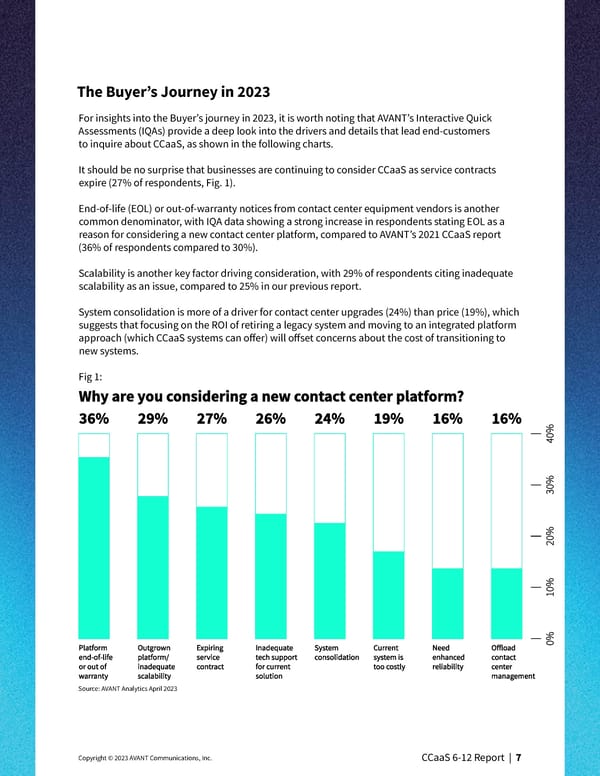

The Buyer’s Journey in 2023 For insights into the Buyer’s journey in 2023, it is worth noting that AVANT’s Interactive Quick Assessments (IQAs) provide a deep look into the drivers and details that lead end-customers to inquire about CCaaS, as shown in the following charts. It should be no surprise that businesses are continuing to consider CCaaS as service contracts expire (27% of respondents, Fig. 1). End-of-life (EOL) or out-of-warranty notices from contact center equipment vendors is another common denominator, with IQA data showing a strong increase in respondents stating EOL as a reason for considering a new contact center platform, compared to AVANT’s 2021 CCaaS report (36% of respondents compared to 30%). Scalability is another key factor driving consideration, with 29% of respondents citing inadequate scalability as an issue, compared to 25% in our previous report. System consolidation is more of a driver for contact center upgrades (24%) than price (19%), which suggests that focusing on the ROI of retiring a legacy system and moving to an integrated platform approach (which CCaaS systems can offer) will offset concerns about the cost of transitioning to new systems. Fig 1: Source: AVANT Analytics April 2023 Copyright © 2023 AVANT Communications, Inc. CCaaS 6-12 Report | 7

CCaaS Market Trends & Research 2023 Page 6 Page 8

CCaaS Market Trends & Research 2023 Page 6 Page 8