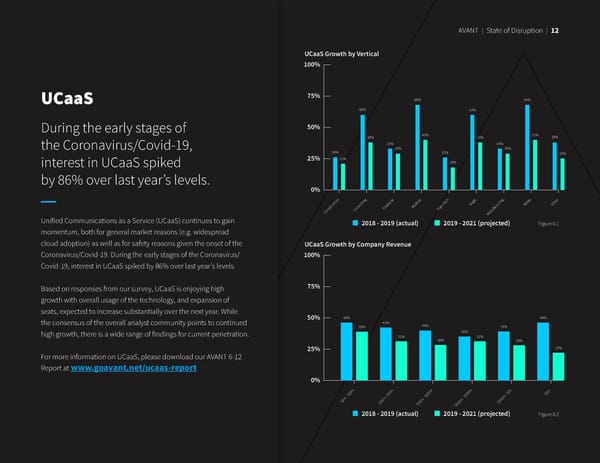

AVANT | State of Disruption | 12 UCaaS Growth by Vertical 100% UCaaS 75% 68% 54% 60% 43% During the early stages of 50% 38% 40% 23% 31% 38% 33% 43% the Coronavirus/Covid-19, 29% 30% 26% 32% 25% 25% 21% interest in UCaaS spiked 18% by 86% over last year’s levels. 0% n g l al h l g il er io in c ga ta h t t i ec e rin e c T L u R Ot tru Med gh t ac ns Consul Financia Hi f nu Co Ma Unified Communications as a Service (UCaaS) continues to gain 2018 - 2019 (actual) 2019 - 2021 (projected) Figure 6.1 momentum, both for general market reasons (e.g. widespread cloud adoption) as well as for safety reasons given the onset of the UCaaS Growth by Company Revenue Coronavirus/Covid-19. During the early stages of the Coronavirus/ 100% Covid-19, interest in UCaaS spiked by 86% over last year’s levels. Based on responses from our survey, UCaaS is enjoying high 75% growth with overall usage of the technology, and expansion of seats, expected to increase substantially over the next year. While 50% 46% 46% the consensus of the overall analyst community points to continued 42% 40% 39% 39% high growth, there is a wide range of findings for current penetration. 35% 31% 31% 28% 28% 25% 22% For more information on UCaaS, please download our AVANT 6-12 Report at www.goavant.net/ucaas-report 0% m $50m m - $1b $1b+ 1m - 501m $1m - $10 $1 $51m - $100m $101m - $500 $ 2018 - 2019 (actual) 2019 - 2021 (projected) Figure 6.2

State of Disruption 2021 Page 13 Page 15

State of Disruption 2021 Page 13 Page 15