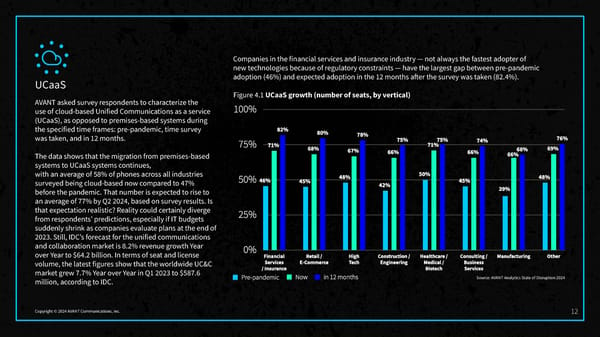

Companies in the financial services and insurance industry — not always the fastest adopter of new technologies because of regulatory constraints — have the largest gap between pre-pandemic adoption (46%) and expected adoption in the 12 months a昀琀er the survey was taken (82.4%). UCaaS Figure 4.1 UCaaS growth (number of seats, by vertical) AVANT asked survey respondents to characterize the use of cloud-based Unified Communications as a service (UCaaS), as opposed to premises-based systems during the specified time frames: pre-pandemic, time survey was taken, and in 12 months. The data shows that the migration from premises-based systems to UCaaS systems continues, with an average of 58% of phones across all industries surveyed being cloud-based now compared to 47% before the pandemic. That number is expected to rise to an average of 77% by Q2 2024, based on survey results. Is that expectation realistic? Reality could certainly diverge from respondents’ predictions, especially if IT budgets suddenly shrink as companies evaluate plans at the end of 2023. Still, IDC’s forecast for the unified communications and collaboration market is 8.2% revenue growth Year over Year to $64.2 billion. In terms of seat and license volume, the latest figures show that the worldwide UC&C market grew 7.7% Year over Year in Q1 2023 to $587.6 Source: AVANT Analytics State of Disruption 2024 million, according to IDC. Copyright © 2024 AVANT Communications, Inc. 12

2024 State of Disruption Report Page 13 Page 15

2024 State of Disruption Report Page 13 Page 15