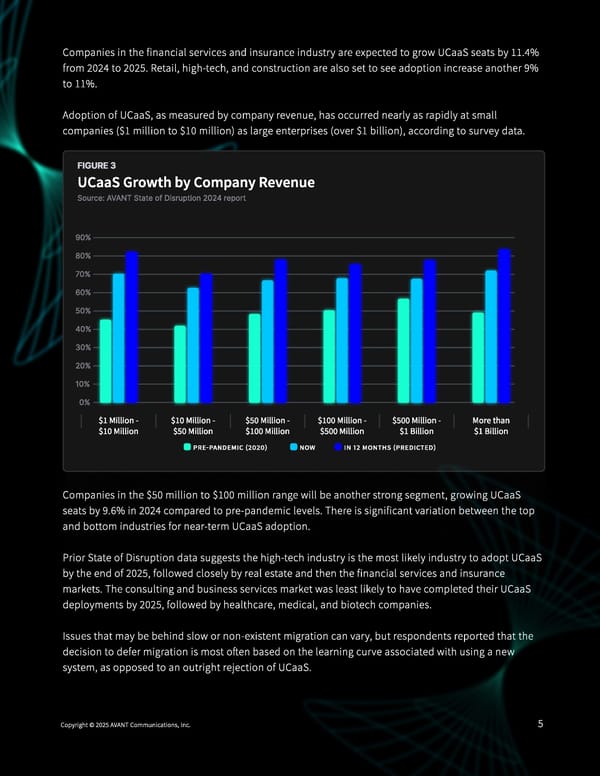

Companies in the financial services and insurance industry are expected to grow UCaaS seats by 11.4% from 2024 to 2025. Retail, high-tech, and construction are also set to see adoption increase another 9% to 11%. Adoption of UCaaS, as measured by company revenue, has occurred nearly as rapidly at small companies ($1 million to $10 million) as large enterprises (over $1 billion), according to survey data. FIGURE 3 UCaaS Growth by Company Revenue Source: AVANT State of Disruption 2024 report 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% $1 Million - $10 Million - $50 Million - $100 Million - $500 Million - More than $10 Million $50 Million $100 Million $500 Million $1 Billion $1 Billion Pre-pandemic (2020) Now In 12 months (predicted) Companies in the $50 million to $100 million range will be another strong segment, growing UCaaS seats by 9.6% in 2024 compared to pre-pandemic levels. There is significant variation between the top and bottom industries for near-term UCaaS adoption. ª Prior State of Disruption data suggests the high-tech industry is the most likely industry to adopt UCaaS by the end of 2025, followed closely by real estate and then the financial services and insurance markets. The consulting and business services market was least likely to have completed their UCaaS deployments by 2025, followed by healthcare, medical, and biotech companies. ª Issues that may be behind slow or non-existent migration can vary, but respondents reported that the decision to defer migration is most often based on the learning curve associated with using a new system, as opposed to an outright rejection of UCaaS. Copyright © 2025 AVANT Communications, Inc. 5

The UCAAS State of Disruption: 2025 Page 6 Page 8

The UCAAS State of Disruption: 2025 Page 6 Page 8